Financial Challenges for Surviving Spouses

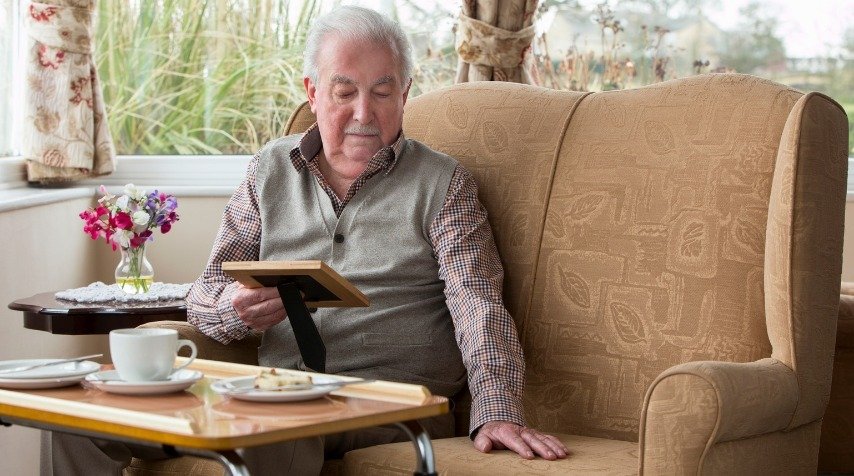

Losing a spouse is not only an emotional hardship but also a financial one. Many surviving spouses face reduced household income, increased expenses, and potential changes in their standard of living. For those who rely on Social Security, pensions, or other joint income sources, the loss of a spouse can create significant financial instability. Estate attorneys must proactively address these concerns and provide solutions that allow clients to maintain financial security and independence.

How a Reverse Mortgage Supports Surviving Spouses

A reverse mortgage offers a critical financial tool for protecting the surviving spouse, ensuring they can remain in their home without the burden of monthly mortgage payments. Here’s how it can help:

1. Eliminating Mortgage Payments With a reverse mortgage, the

surviving spouse can remain in the home without the obligation of

making monthly mortgage payments, reducing financial strain and

providing a sense of security.

2. Providing a Source of Income Reverse mortgage proceeds can be

structured as a line of credit, lump sum, or monthly payments,

ensuring a steady stream of income to cover daily expenses and

unexpected costs.

3. Preserving Other Assets Instead of liquidating investment accounts

or selling off valuable assets, a reverse mortgage allows the

surviving spouse to tap into home equity, preserving their savings

and financial portfolio.

4. Covering Long-Term Care and Healthcare Costs As healthcare costs

continue to rise, surviving spouses may need additional financial

support for in-home care, medical bills, or assisted living. A reverse

mortgage provides liquidity for these expenses without depleting

other retirement funds.

5. Ensuring the Spouse Can Age in Place Many surviving spouses wish

to remain in their home, where they feel comfortable and secure. A

reverse mortgage supports this goal by providing financial stability

without the need to relocate or downsize.

surviving spouse can remain in the home without the obligation of

making monthly mortgage payments, reducing financial strain and

providing a sense of security.

2. Providing a Source of Income Reverse mortgage proceeds can be

structured as a line of credit, lump sum, or monthly payments,

ensuring a steady stream of income to cover daily expenses and

unexpected costs.

3. Preserving Other Assets Instead of liquidating investment accounts

or selling off valuable assets, a reverse mortgage allows the

surviving spouse to tap into home equity, preserving their savings

and financial portfolio.

4. Covering Long-Term Care and Healthcare Costs As healthcare costs

continue to rise, surviving spouses may need additional financial

support for in-home care, medical bills, or assisted living. A reverse

mortgage provides liquidity for these expenses without depleting

other retirement funds.

5. Ensuring the Spouse Can Age in Place Many surviving spouses wish

to remain in their home, where they feel comfortable and secure. A

reverse mortgage supports this goal by providing financial stability

without the need to relocate or downsize.

Addressing Common Concerns for Surviving Spouses

Will the spouse be forced to leave the home? If both spouses were listed as borrowers on the reverse mortgage, the surviving spouse can remain in the home with the same protections as the original agreement.

What if the surviving spouse was not listed on the reverse mortgage? If the non- borrowing spouse meets certain eligibility criteria, they may still be able to remain in the home under FHA guidelines, ensuring continuity and stability.

How does this impact inheritance? Heirs will still have the option to

keep the home by paying off the loan balance or selling the property

and retaining any remaining equity.

keep the home by paying off the loan balance or selling the property

and retaining any remaining equity.